QuentinJcb.github.io

Machine Learning & Quantitative Finance

Taxonomy of the Dow Jones Industrial Average [1/2]: the Minimum Spanning Tree case

In this short post, we analyse the correlations between the 30 constituents of the DJIA. The daily prices of all US stocks and ETF are available on Kaggle. This dataset is made of one file for each security containing the date, the open, high, low and close prices, the volume and the open interest. The approach followed is the following:

- First, we load the datasets of all DJIA stocks and compute the daily returns

- We then select the days for which the data for all 30 stocks are available

- On this period, we compute the pairwise correlations and pairwise distances derived from these quantities

- Finally, we compute the minimum spanning tree associated with these distances

Data Loading

The file DOW.csv contains te tickers and names of the 30 companies composing the DJIA. The first step is to load this file in order to have access to the tickers list:

import os

import pandas as pd

import numpy as np

constituents = pd.read_csv('Data/dow.csv', sep='\t', header=None)

tickers = constituents[0].apply(str).values

tickers is an array containing the symbols of the 30 stocks.

Now, we have to load the price data of these specific stocks. We must pay attention to the empty files of the folder.

os.chdir('Data/Stocks') # We move to the folder containing the txt stock files

filenames = [file for file in os.listdir() if file.endswith('.txt')\

and os.path.getsize(file) > 0 and file.split('.')[0].upper() in tickers]

filenames = sorted(filenames)

The list filenames contains the names of the datasets of the 30 stocks. We then load all these files:

list_df = [] # This list will contain the 30 dataframes

for file in filenames:

df = pd.read_csv(file)

df = df[['Date', 'Close']] # Open, High, Low, Volume and OpenInt are not relevant in our case

df.index = df.Date

df['return'] = np.log(df.Close) - np.log(df['Close'].shift())

df.drop(labels=['Date', 'Close'], inplace=True, axis=1)

df.columns = [file.split('.')[0].upper()]

list_df.append(df)

data = pd.concat(list_df, axis=1) # The 30 dataframes are merged on their index (date)

data.dropna(axis=0, how='any', inplace=True) # We select only the period when all stocks are listed

This dataframe has 30 columns (one for each stock) and 2430 rows (about 10 years of daily returns).

Correlations

We can now compute the correlation matrix:

corr = data.corr()

These correlation coefficients can be turned into distances using the formula . We can show that this function statisfies all the properties of a mathematical distance. So, we transform the correlation matrix into a distance matrix:

def distance(rho):

return 10 * np.sqrt(2 * (1 - rho))

dist_matrix = distance(corr).values

The prefactor in front of the distance is used to make future plots clearer.

Minimum Spanning Tree

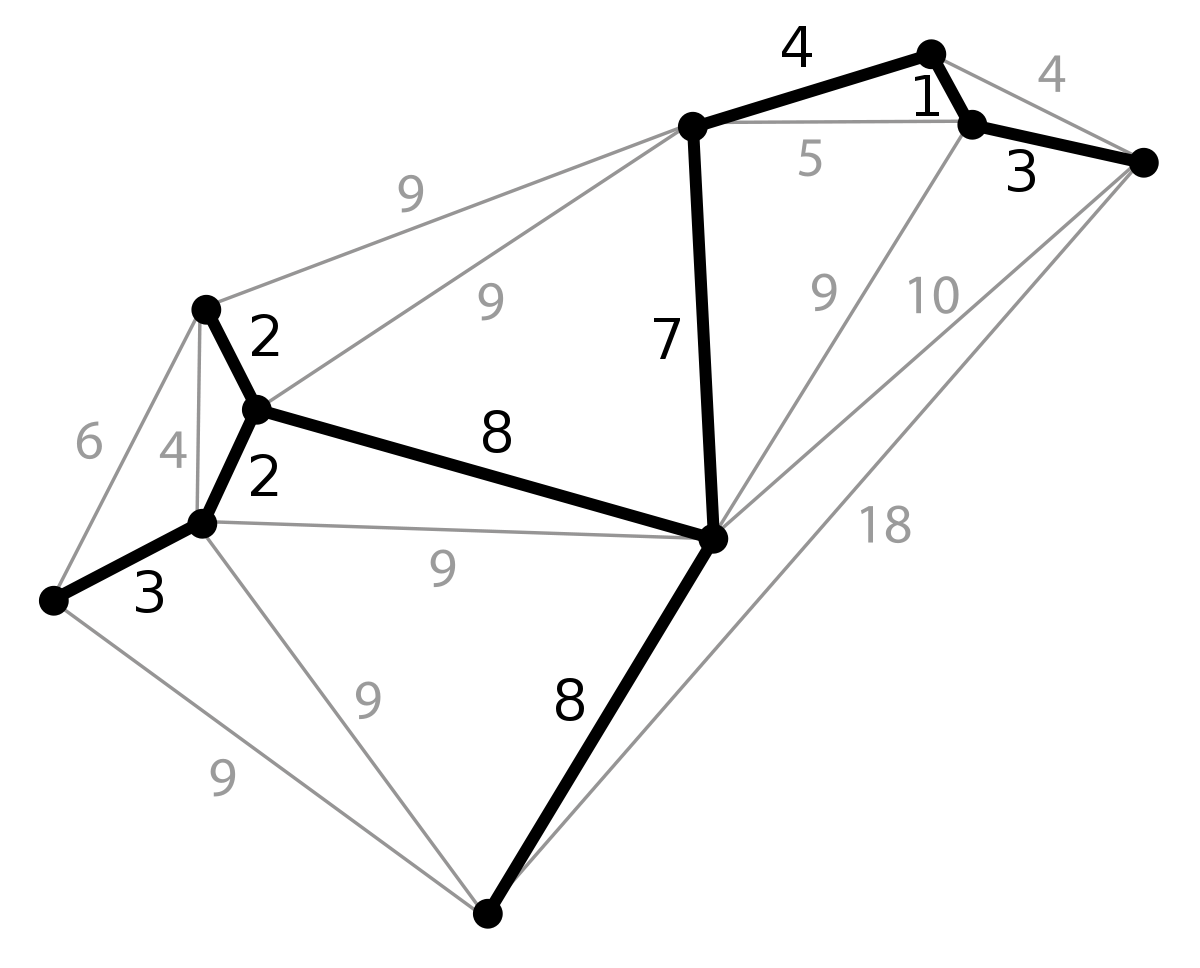

The matrix dist_matrix can be thought as the adjacency matrix of a particular undirected graph, where is the distance associated with the edge connecting nodes and . For instance, the stock nearest Apple (AAPL) is Intel (INTC). On this graph, we can define some trees which are defined as connex graphs without any cycle. In particular, we can consider the trees containing all the 30 stocks and define their length as the sum of the distances between each node. A minimum spanning tree is a tree of minimum length containing all the stocks. The image below shows a graph and the associated minimum spanning tree.

There are three common algorithms to find this tree:

- Otakar Borůvka’s algorithm

- Prim’s algorithm

- Kruskal’s algorithm

The complexity is where is the number of edges and the number of vertices , except for Prim’s algorithm where it can be depending on the graph.

In python, the libraries networkx and scipy provide some tools to deal with graphs. In particular, scipy allows to compute the minimum spanning tree directly from the adjacency matrix:

from scipy.sparse.csgraph import minimum_spanning_tree

tree = minimum_spanning_tree(dist_matrix)

tree = tree.toarray().astype(float)

We can now use networkx to draw the minimum spanning tree found above:

import networkx as nx

import matplotlib.pyplot as plt

labels = list(data.columns) # tickers

graph = nx.from_numpy_matrix(tree)

mapping = dict(zip(graph, labels))

graph = nx.relabel_nodes(graph, mapping) # nodes are characters a through z

plt.figure(figsize=(10,10))

plt.axis('off')

nx.draw_networkx(graph, c='r', alpha=0.7)

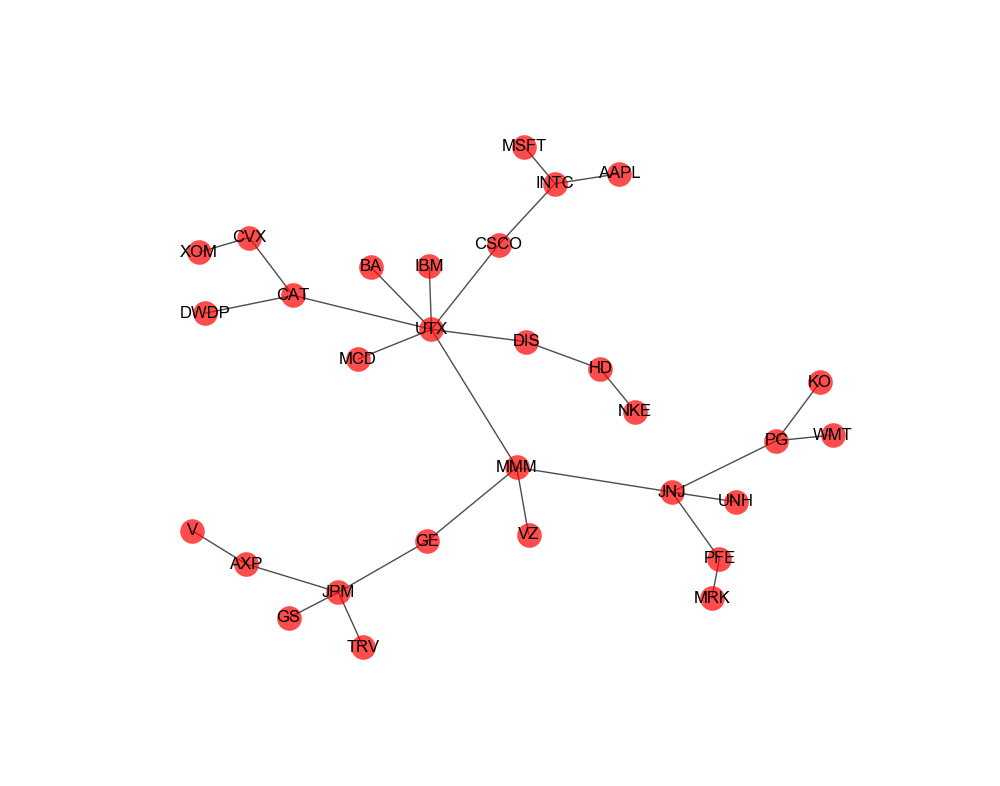

Economic clusters are clearly observable on this tree: at the top-right corner, we can spot tech companies grouped together, while financial service companies are visible in the lower-left corner. Therefore, the classification obtained makes sense from an economic point of view.